how much will my credit score increase with a car loan

If you have a five-year. After you have signed up for the trial you will prompted to refresh your 3-bureau credit scores - do this.

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Score Credit Repair Business Credit Repair

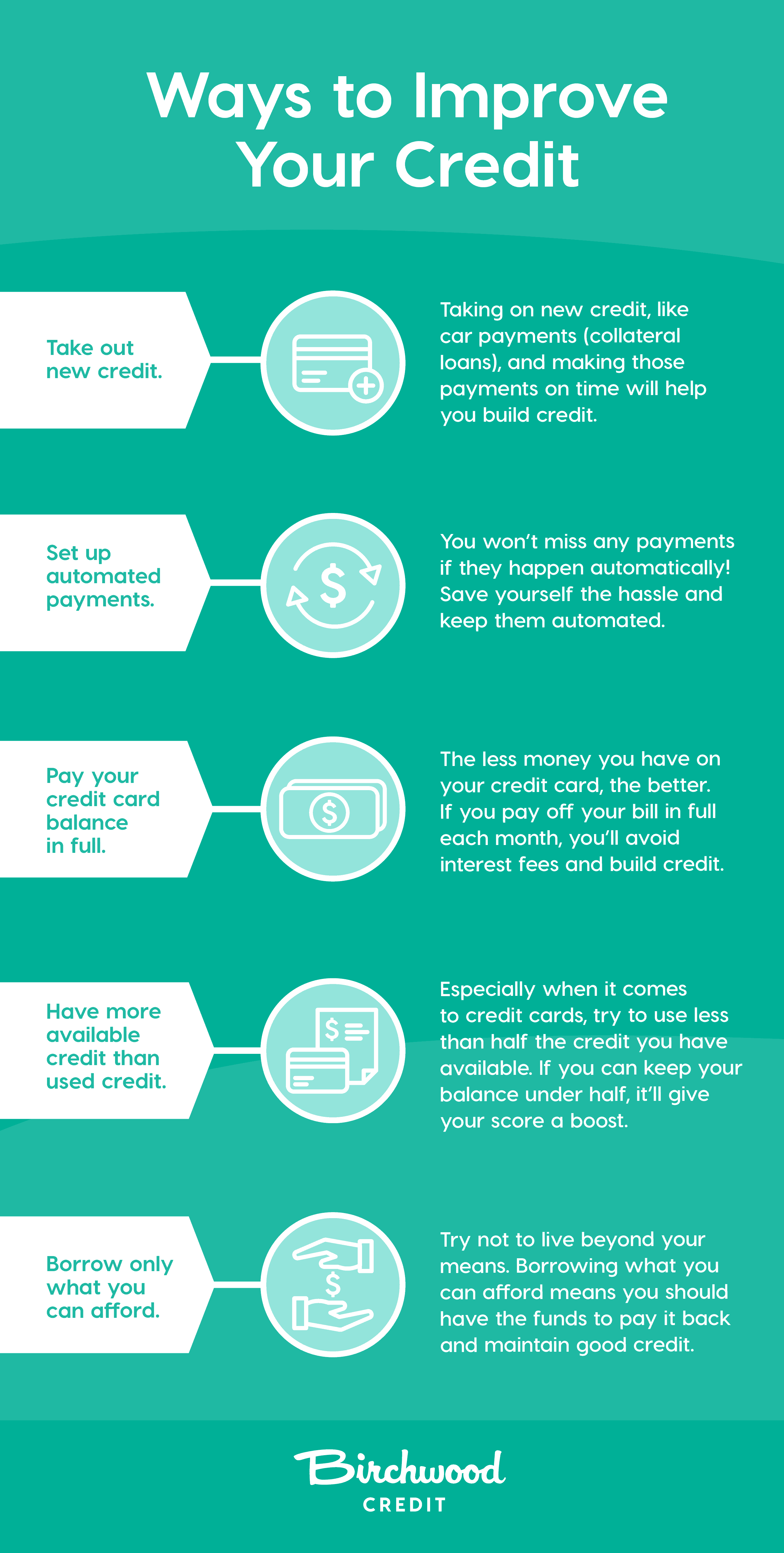

Avoid taking out a loan that exceeds what you can pay.

. Learn about credit how to build it and how to maintain it. 15 Length of credit history. If you currently have a high utilization rate over 30 paying down credit card balances could be a quick way to increase your credit scores.

Most of us 84 rely on financing when purchasing a vehicle according to data from Experian Automotive fourth quarter 2014 and the average loan amount for a new. Ad Increase your FICO Score Get Credit for the Bills Youre Already Paying. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle.

Getting a car loan when your credit is between 600 and 699 can be significantly more expensive than it is for borrowers with better credit scores. As you make on-time loan payments an auto loan will improve your credit score. Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders.

Here is how your FICO credit score is calculated. Here is how its calculated. Pick a plan pay monthly to build credit history.

Generally speaking when you pay off a car loan or lease your credit score will take a mild hit. Explore our free course. The Carolinas Lead the Country With Biggest Increase in Car Loans.

Ad Improving and leveling up your credit can help you achieve your housing goals. Experts have stated that your credit score will begin to improve within just a few months after paying off your car. A good credit score is generally considered to be 700 or above.

I need to buy a car soon and Im not sure if I should wait to try to improve my credit score to get a better rate on a can loan. Compare Apply Today. Ad View your latest Credit Scores from All 3 Bureaus in 60 seconds.

If you already have a credit score in the. Ad Read Expert Reviews Compare Your Car Financing Options. Pre-qualified Shoppers See Real Terms And Actual Monthly Payments For Every Vehicle.

Throughout your life you build a credit score which can change over time. Anything below 640 is considered poor credit. Sign up for the 7-day trial.

Paying off a car loan can allow more breathing space by reducing your. 1 day agoInstantly increase your credit scores for free. Consolidate credit card debt.

Free Dark Web Scan. Answered on Dec 15 2021. Your score will increase as it satisfies all of the factors the.

In a nutshell the FICO credit scoring formula the most commonly used scoring. It might be a simple five-step one such as Excellent Good Fair Poor and Bad. No Credit Card Required.

Payment history makes up 35 of. In recent analyses of consumer credit behavior Experian has been using these tiers. Youre not alonemany people with car loans question when to pay it off.

The impacts of a car loan start with the first inquiry on your credit score. It is 7-days free then 2499month. Lenders usually decide upon loan approval based on your credit score.

The good news is financing a car will build credit. If your credit score is below. Ad Get Pre-Approved To See Your Real Terms For Every Vehicle.

You Can Increase your FICO Score for Free. Average credit scores fall in the range of 640 to 699. The answer potentially a lot.

There are five factors that. It all depends on how you manage the loan how much the loan is for and how you honor the commitment. How long after paying off a car loan does credit improve.

But if paying off a car loan decreases your average account age. In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the. Pre-qualified Shoppers See Real Terms And Actual Monthly Payments For Every Vehicle.

From my own experience paying off several auto loans whenever I. For example if paying off a car loan bumps your average account age from four to six it could boost your score. Ad Increase your Credit Score by an average of 32 points with a Self Credit Builder Account.

The car loan remains on your credit for the life of the loan plus another 10 years. If you manage the repayments. Unfortunately when you first pay off your car your credit score will slightly go down and will not increase.

My car was in a wreck and was a total loss so that loan with a. A car loan can help improve your credit score if they are handled correctly. Now go to the top right.

Missing Payments Accruing More Debt Than Income And Applying For Or Canceling A Lot Of Credit Cards Will Negative Car Loans Credit Score Improve Credit Score

How To Get Approved For A Car Loan With Bad Credit In Canada

What S The Minimum Credit Score For A Car Loan Credit Karma

Minimum Credit Score For Car Loan Ridetime Canada

What Credit Score Do You Need For A Car Loan Loans Canada

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

What Is Considered Bad Credit Legacy Auto Credit

Credit Score Range What Is The Credit Score Range In Canada

What Minimum Credit Score Do You Need To Buy A Car Nerdwallet

Does Financing A Car Build Credit

How To Get A Car Loan With Bad Credit Forbes Advisor

Stressed For Time Fill Out Our Financing Application Online Any One Of Our Friendly Sales Representatives Will Fol Car Finance Car Loans Car Loan Calculator

What Is Considered A Good Credit Score Good Credit Score Good Credit Credit Score Infographic

What Credit Score Is Needed To Buy A Car Lendingtree